|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Company to Refinance House: Expert Insights and TipsRefinancing your home can be a strategic move to reduce monthly payments or to access equity for other needs. Identifying the best company to refinance house involves considering factors like interest rates, customer service, and loan options. Factors to Consider When RefinancingInterest RatesThe interest rate is a crucial factor in refinancing. A lower rate can significantly reduce your monthly payments. Customer ServiceGreat customer service can make the refinancing process smoother and less stressful.

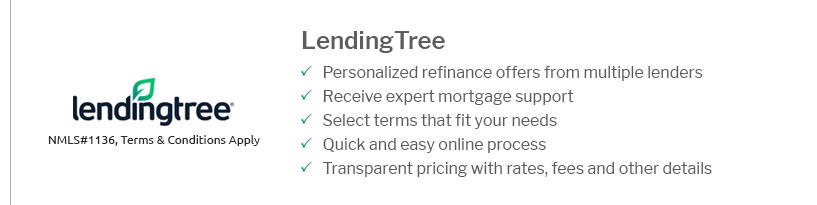

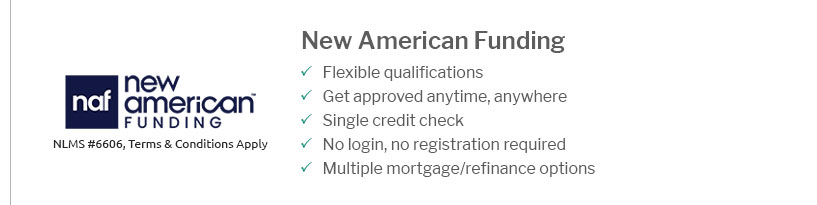

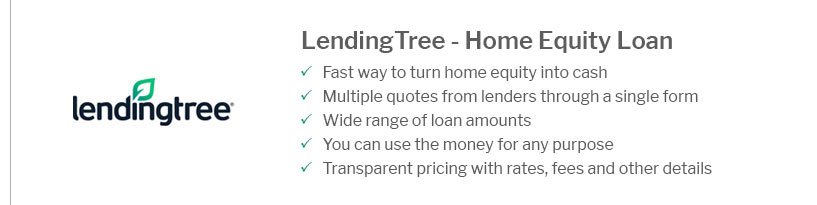

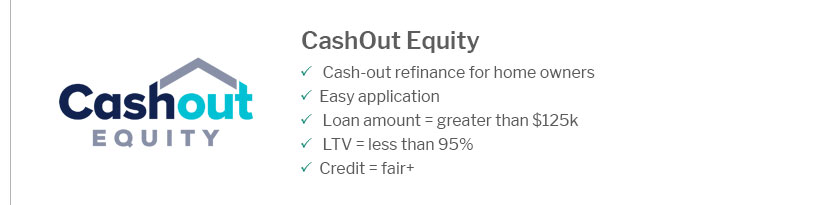

Loan OptionsDifferent lenders offer various loan products. It's essential to choose a company that provides flexible loan terms. Top Companies to Consider

Steps to Find the Best Refinance CompanyResearch and CompareStart by researching multiple companies. Compare their rates, fees, and reviews from past customers. Consult with a Financial AdvisorA financial advisor can provide personalized advice based on your financial situation and goals. Use Online ToolsUtilize online tools to estimate savings and understand terms better. You might want to consider options like refinance to take cash out as part of your strategy. FAQs on Refinancing

https://better.com/refinance-rates

Refinance rates - 30-yr fixed. Rate. 6.750%. APR. 6.954%. Points (cost). 2.06 ($3,291). Term. 30-yr fixed. Rate - 30-yr fixed FHA. Rate. 6.250%. APR. 6.453% ... https://www.investopedia.com/mortgage/refinance/how-pick-right-lender/

Yes. You don't have to refinance your mortgage with your current lender. You can compare and shop for the mortgage lender that best suits your financial ... https://www.bankrate.com/mortgages/refinance-rates/

30 year fixed refinance. Points: 1.456. 8 year ...

|

|---|